german tax calculator for foreigners

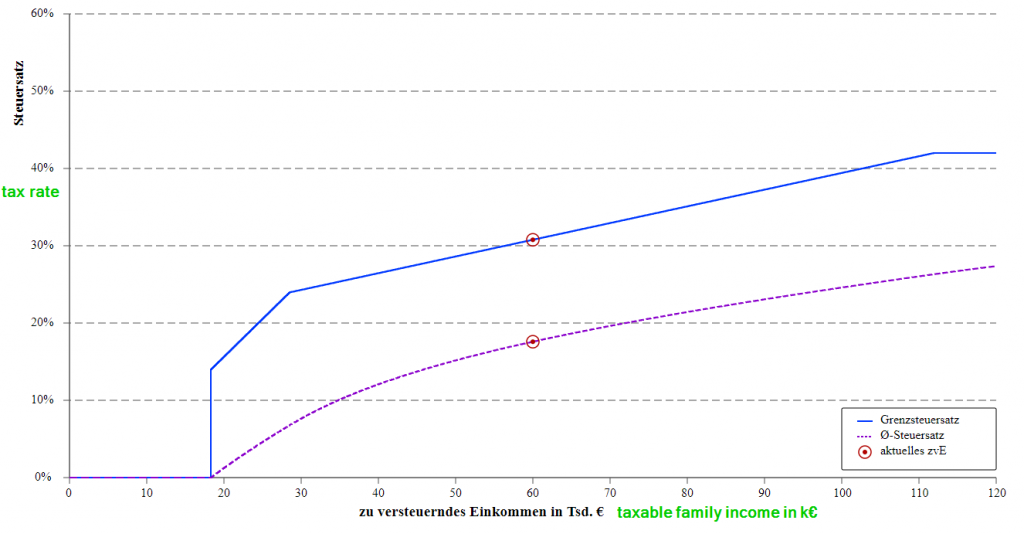

Income from self-employment that took place abroad. The German tax system can be pretty complicated as the German tax system is progressive.

Personal Income Tax Solution For Expatriates Mercer

2020 income tax rates A 55 solidarity surcharge is imposed on the income tax liability of all taxpayers.

. Gross Net Calculator 2022 of. You want to quickly calculate the probable amount of your income tax when working in. The German Tax calculator is a free online tax calculator updated for the 2022 Tax Year.

Biden Corporate Tax Increase Details Analysis. How much money will be left after paying taxes and social contributions which are. An employee with an yearly income of 9744 wont have to pay income tax for married employees the limitation will be 19488.

Good to know before you fill in the salary calculator Germany. German tax calculator for foreigners Saturday February 26 2022 Edit. All you have to do is select the federal state in which you reside.

The top 45 rate in Germany kicks in at the equivalent of just under 300000 USD income per year for a single individual while the top US taxes arent paid until youre earning. If no church tax must be paid the rate is 26375. Corporate tax is paid at a flat rate of 15.

Income tax in germany for foreigners calculator. The income tax rate for residents whose taxable income does not exceed 9408 per year is 0 between 9408 and 57051 per year 14 between 57051 and 270500 per. Income tax in germany for foreigners calculator.

The tax is only due on the capital gains above the savers lump sum of 801 euros per person. The calculator is provided for your free use on our. See estimated tax refund After completing the information you can see how much you could get back when filing your tax.

The German Income Tax Calculator is designed to allow you to calculate your income tax and salary deductions for the 2022 tax year. Our tax calculator for Germany Steuerrechner can estimate your take-home salary and total taxes due in just a few clicks. It starts at 1 and.

If a German tax resident is a member of a church entitled to impose church tax. Thus the capital gains tax including surcharges at 279951 of the profit achieved at 9 church tax or 278186 at 8 church tax. Our grossnet calculator enables you to easily calculate your net wage which remains after.

The average tax burden is significantly lower. Our online calculator is simple and intuitive everyone can do it. German income tax calculator this program is a german income tax calculator for singles as well as married couples for the years.

German tax calculator for foreigners Thursday November 3 2022 2022 2021 and earlier. Just ring us through and we will call you back as. This program is a German Wage.

Our gross net wage calculator helps to calculate the net wage based on the Wage Tax System of Germany. 2022 2021 and earlier.

German Tax Calculator 2022 23 Income Tax Calculator

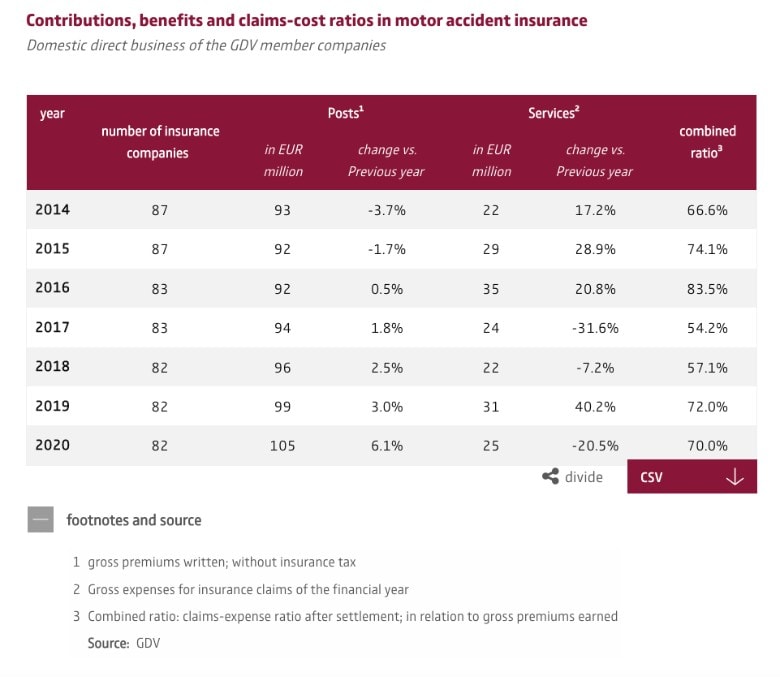

Car Insurance In Germany In Depth 2022 English Guide

Income Tax In Germany For Expat Employees Expatica

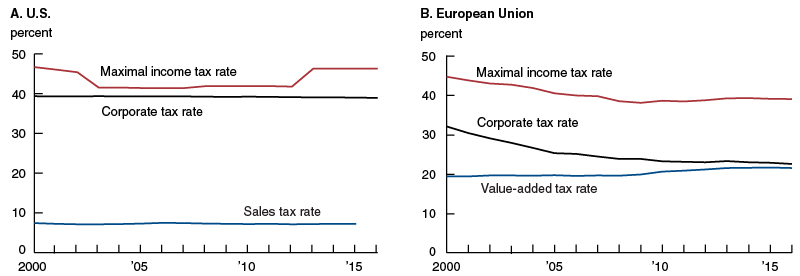

The Burden Of Taxation In The United States And Germany Federal Reserve Bank Of Chicago

Faq German Tax System Steuerkanzlei Pfleger

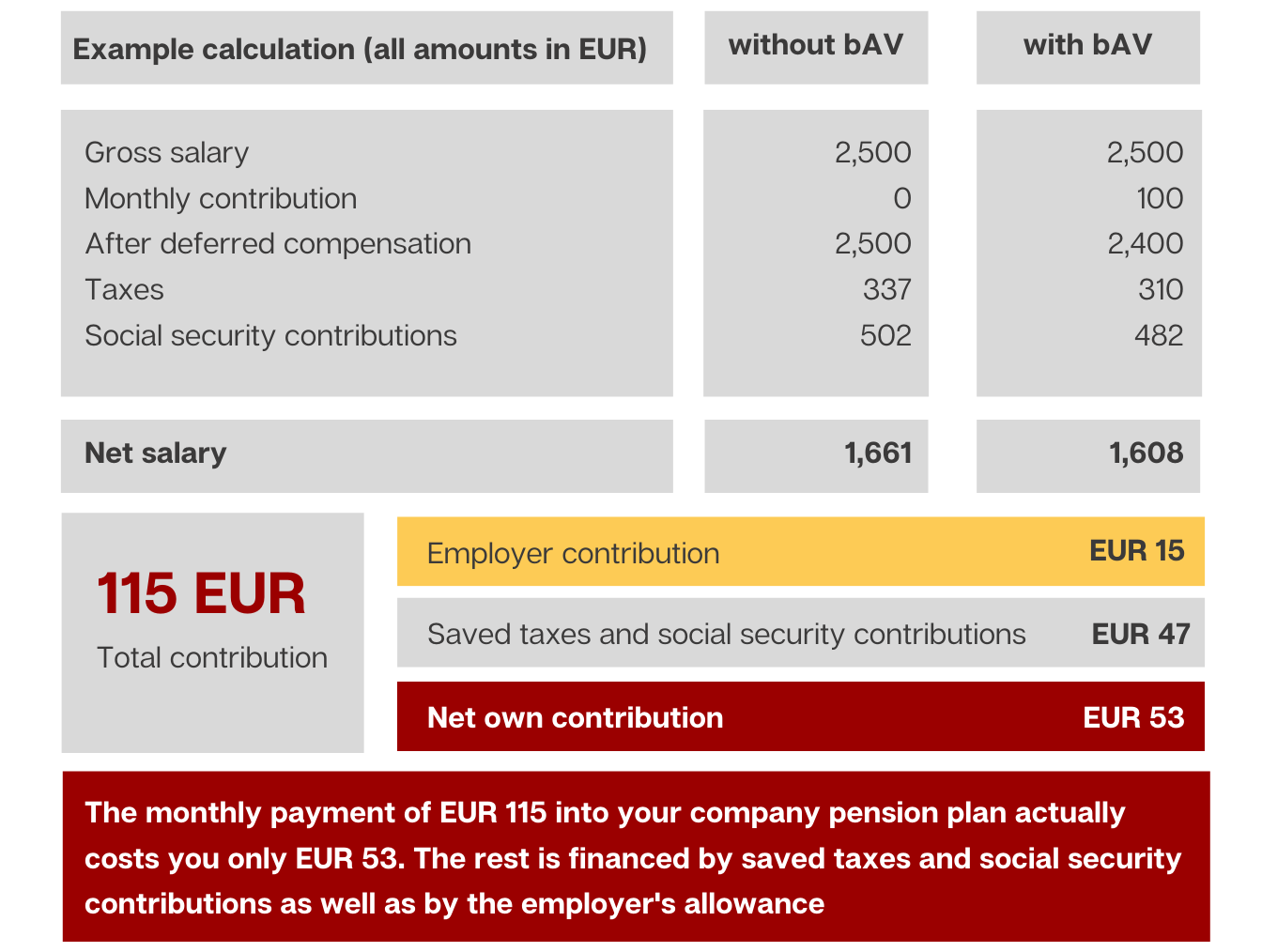

Company Pension Schemes In Germany Information Advice

Crypto Tax Guide Germany 2022 Kryptowahrung Steuer 2022 Koinly

What German Households Pay For Power Clean Energy Wire

German Annual Income Tax Return Declaration And Calculator Lies On Accountant Table Close Up The Concept Of Taxpaying Period In Germany And Europe Stock Photo Alamy

German Income Tax Calculator Expat Tax

Taxes In Germany Who Has To Pay Them And How Much Are They Penta

German Tax Id This Is How You Get One Fast How It Works Sib

Tax On Footballers Salaries Tax Rates In Top 5 European Leagues

German Vat Calculator Vatcalculator Eu

Everything You Need To Know About Your German Tax Return In 2022

German Income Tax Calculator All About Berlin

Mobility Basics What Are Tax Equalisation And Tax Protection Eca International