omaha ne sales tax rate 2019

N Sunday October 9 2022 Edit. Sales and Use Tax.

/cloudfront-us-east-1.images.arcpublishing.com/gray/GWD72JJSIJPELDS6SGPS56KO3I.jpg)

Mayor Proposes Omaha Annexations

Iowas is 6 percent.

/cloudfront-us-east-1.images.arcpublishing.com/gray/GWD72JJSIJPELDS6SGPS56KO3I.jpg)

. Request a Business Tax Payment Plan. The state capitol Omaha has a. Registration Fees and Taxes.

Make a Payment Only. This is the total of state county and city sales tax rates. This is the total of state county and city sales tax rates.

Megan Hunt of District 8 during the first day of the 2019 Legislative Session at the Nebraska. 51 rows 75 Sales and Use Tax Rate Cards. The 7 sales tax rate in Omaha consists of 55 Nebraska state sales tax and 15 Omaha tax.

There is no applicable county tax or special tax. 05 lower than the maximum sales tax in NE. Driver and Vehicle Records.

The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. State sales tax. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales.

A new 05 local sales and use tax takes effect. What is the sales tax rate in Omaha Nebraska. Sales Tax Rate Finder.

Alice Homan 8 of Omaha pretends to use a telephone alongside her mother Sen. Tax Commissioner Tony Fulton announced the following changes in local sales and use tax rates for the upcoming quarter. The sales tax rate in Omaha is 7.

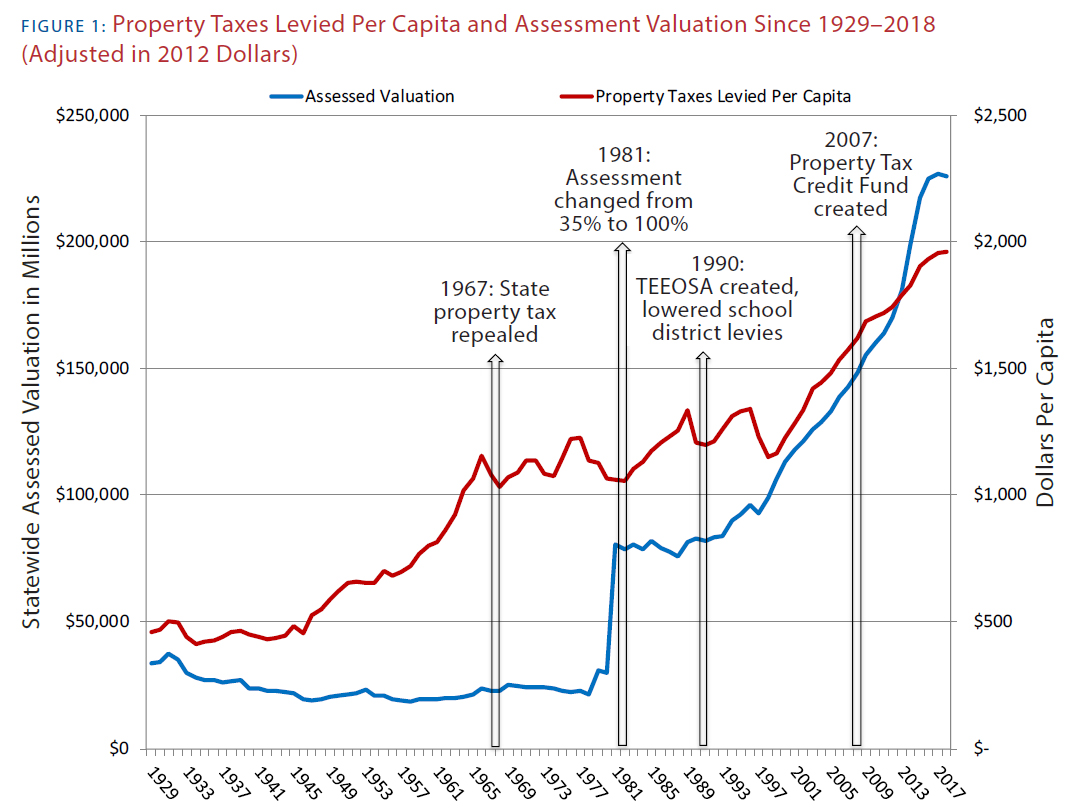

Visit this page dedicated to Omaha area property taxes why they are so high what you get and more. January 2019 sales tax changes Dakota City. The county sales tax rate is.

Nebraska sales tax changes effective July 1 2019. There is no applicable county tax or special tax. Omaha ne sales tax rate 2019.

The 7 sales tax rate in Elkhorn consists of 55 Nebraska state sales tax and 15 Elkhorn tax. Sale tax rates vary from city to city. The minimum combined 2022 sales tax rate for Omaha Nebraska is.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022. You can print a 7 sales tax table here. Tax information for Nebraska.

There is no applicable county tax or special tax. Several local sales and use tax rate changes will take effect in Nebraska on January 1 2019. The Nebraska state sales and use tax rate is 55 055.

05 lower than the maximum sales tax in NE. With local taxes the total sales tax rate is between 5500 and 8000. Counties and cities in Nebraska are allowed to charge an additional local sales tax on.

The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax. Nebraskas sales tax rate is 55 percent. Nebraska Application for Direct Payment Authorization 122020 20DP.

Local sales taxes may result in a higher percentage. The Nebraska state sales and use tax rate is 55 055.

Used Buick For Sale In Omaha Ne Edmunds

Nebraska Income Tax Calculator Smartasset

Get Real About Property Taxes 2nd Edition

Cryptocurrency Tax Calculator Forbes Advisor

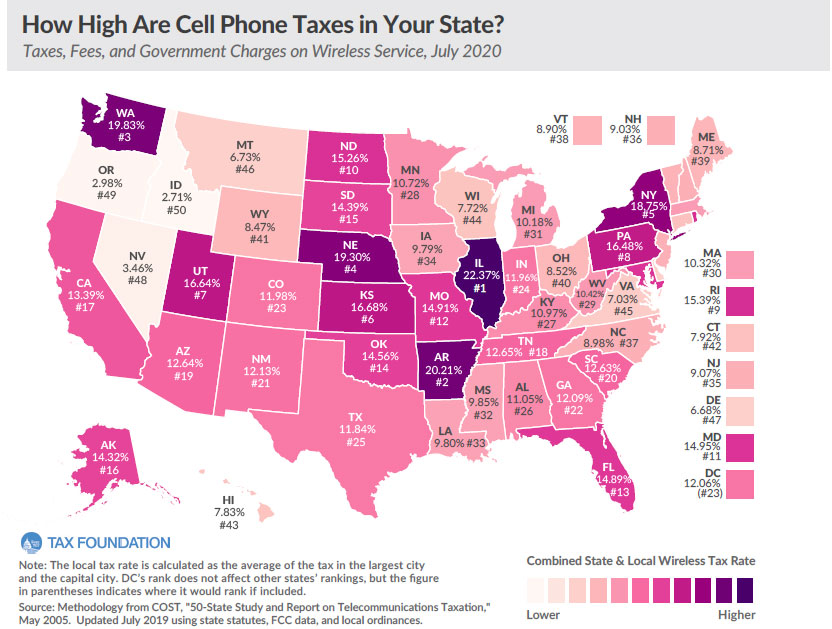

Nebraska Has 4th Highest Wireless Tax Burden In The Nation

/cloudfront-us-east-1.images.arcpublishing.com/gray/GWD72JJSIJPELDS6SGPS56KO3I.jpg)

Mayor Proposes Omaha Annexations

How To Get A Resale Certificate In Nebraska Startingyourbusiness Com

Sales Taxes In The United States Wikipedia

26 Of Us S Richest Billionaires Paid 4 8 Percent Tax Rate In Recent Years

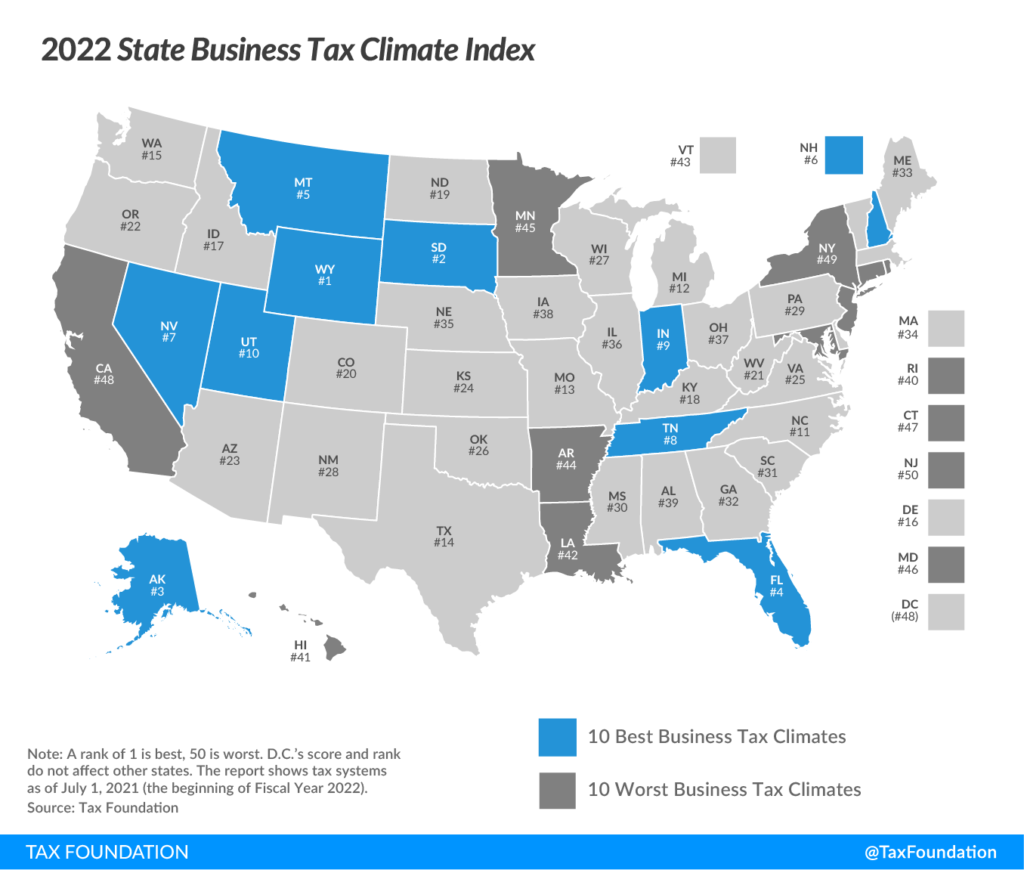

Nebraska Strongest Job Recovery Market Resides In Nebraska Rebounding From The Pandemic The Cornhusker State Flexes Its Muscle Site Selection Magazine

Sales Taxes In The United States Wikipedia

Video Center Nebraska Department Of Revenue

Pre Owned Mercedes Benz Sales In Omaha Ne Pre Owned Mercedes Benz

Nebraska Taxes At A Glance Open Sky Policy Institute

Omaha Nebraska Ne Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Sales Taxes In The United States Wikipedia